The Single Strategy To Use For 3 Types Of Business Bankruptcy

Table of ContentsExamine This Report on Different Types Of Bankruptcies In AmericaThe Greatest Guide To What Are The Different Types Of Bankruptcy?Indicators on Bankruptcy Attorney Near Me You Should KnowOther Types Of Bankruptcy Can Be Fun For Everyone

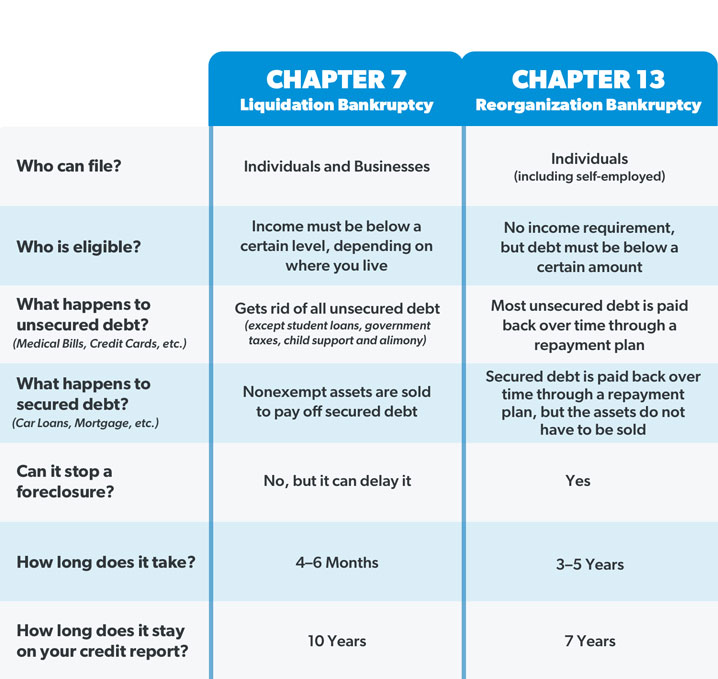

Phase 11 personal bankruptcy is a reconstruction strategy most typically utilized by huge companies to help them remain energetic while paying back creditors. Chapter 13 insolvency gets rid of financial debts through a settlement plan that lets you repay a part of your debt over a 3- or five-year duration (bankruptcy attorney). Chapter 7, Chapter 11 and Phase 13 insolvencies all effect your credit report, as well as not all your debts may be wiped out. Under Chapter 7, you can swiftly eliminate the majority of your unprotected financial obligations by surrendering your assets. Unsafe financial obligations are debts not secured with security, including most individual loans as well as bank card. People certify for Chapter 7, however partnerships or corporations with assets that can be sold off to cover financial obligations additionally qualify.

Under Chapter 7, you can swiftly eliminate the majority of your unprotected financial obligations by surrendering your assets. Unsafe financial obligations are debts not secured with security, including most individual loans as well as bank card. People certify for Chapter 7, however partnerships or corporations with assets that can be sold off to cover financial obligations additionally qualify.Some properties are excluded from sale, but all nonexempt assets might be included in the liquidation procedure. When you submit a petition for Chapter 7 personal bankruptcy, usually all collection activities versus you pull up. This suggests financial institutions ought to no more be able to garnish your wages, phone call as well as demand repayment or start a legal action versus you.

The Different Chapters Of Bankruptcy Explained Fundamentals Explained

If your Chapter 7 bankruptcy is successful, you obtain a discharge that releases you from individual responsibility for your financial debts. Submitting Phase 11 bankruptcy primarily indicates you're submitting a reconstruction strategy to restructure your debts to help you settle your lenders in time. It's usually made use of by huge services, yet it can likewise assist particular individuals and also small-business proprietors.

If you're submitting Phase 11 insolvency as a company, it helps you produce a plan to maintain your business energetic while paying all your financial institutions over a set duration. When a business files a request for Phase 11 with the court, it might be volunteer or uncontrolled. A voluntary request is submitted by the organisation, but an uncontrolled request is filed by the organisation' lenders as soon as specific demands have actually been satisfied.

If you're submitting Phase 11 insolvency as a company, it helps you produce a plan to maintain your business energetic while paying all your financial institutions over a set duration. When a business files a request for Phase 11 with the court, it might be volunteer or uncontrolled. A voluntary request is submitted by the organisation, but an uncontrolled request is filed by the organisation' lenders as soon as specific demands have actually been satisfied.When creating your reorganization plan, you position each of your financial institutions into its own class. Unsecured financial debts are put in a separate course as well as never ever abided with any kind of various other debts (bankruptcy attorney near me). Priority for payment is placed on specific financial debts, which implies these are paid prior to others. Chapter 13 is the second most typical sort of bankruptcy as well as used mostly by individuals.

The smart Trick of Attorney For Bankruptcy In Camp Hill Pa That Nobody is Discussing

You make regular monthly repayments to a court trustee, and the trustee disperses the money to your creditors. check these guys out At the end of your strategy, the staying debts are discharged. Submitting Chapter 13 develops an automated remain that quits a lot of collection actions, which generally indicates creditors can not look for wage garnishments, make telephone calls demanding repayment or file lawsuits.

However, you should remain to pay your mortgage, or the loan provider can get the court to begin foreclosure process. Phase 13 personal bankruptcy functions especially well if you can afford to pay some, but not all, of your financial obligation. If you're confronted with unsafe debts, including bank card and clinical costs, Chapter 13 helps you achieve an extra workable and also economical payment.

It protects your building while giving you time to pay off your debts and also lawyer charges within a regular monthly layaway plan. Chapter 7 is usually a more budget-friendly choice when contrasted to Phases 13 as well as supplies a relatively quick way to get out from under your financial obligations. Submitting Chapter 7 could be an excellent alternative if you: Own little or no home Have an income level that passes the ways examination Have primarily unsecured financial obligation, such as medical costs, bank card debts as well as individual lendings Don't intend to be stuck to a repayment strategy for the following three or five years When you have financial debts that won't be released, such as overdue revenue tax obligations, domestic support commitments or student finances, Chapter 13 may be the much better option.

Rumored Buzz on Understanding Chapter 7, 11, And 13 Bankruptcy

If you check this link right here now have a high revenue that invalidates you for Phase 7 and also you can manage to pay a few of your debt, Chapter 13 may be your only choice. Naturally, don't take our word for it. If you're thinking of filing for bankruptcy, consult a certified lawyer. They can aid you decide which Phase of insolvency is best for your circumstance.

This suggests that, in Chapter 7, you're required to sell your assets to pay as several creditors as feasible. Chapter 11 allows you discuss with your lenders to customize the regards to your financial debts as well as produce a settlement plan without needing to sell your assets. While individuals and also organisations can utilize either sort of personal bankruptcy, Phase 7 is typically favored by people - bankruptcy attorney near me.

Significant distinctions between Chapter 11 and Chapter 13 are eligibility needs. Phase 11 is open to practically any kind of private or business with no certain revenue or debt-level restrictions. Chapter 13 needs you to have a secure income, has specific debt limitations and is booked for individuals or, in restricted situations, single proprietorships.